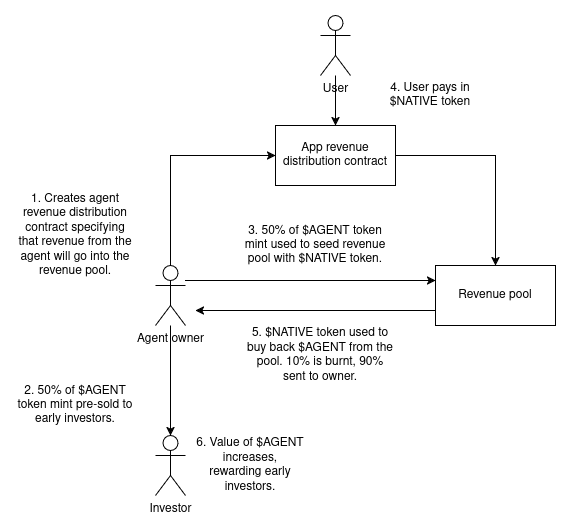

Tokenized Agents & Revenue Pools

Being a revenue-generating entity, an agent can also constitute a financial asset. We propose the following crowd-funding/investment mechanism to enable creators to fund agent development.

-

Revenue Distribution Contract:

The Agent Owner creates a revenue distribution contract specifying that $NATIVE token revenue from the agent will be used to buy $AGENT tokens from the agent's Revenue Pool—a Uniswap v2 style liquidity pool. -

Token Minting:

The $AGENT token is minted, with 50% being made available for sale to early investors. The remaining 50% of the $AGENT tokens are used to seed the Revenue Pool. The amount of $NATIVE tokens paid in along with these $AGENT tokens determines their launch price. -

User Interaction & Revenue Generation:

Users interact with the agent, paying in $NATIVE tokens. This interaction may come in multiple forms – for example:- Paying to copy-trade a Trading Agent,

- Using a clone of a successful Engagement Agent to manage their social media accounts,

- Interacting with a Companion Agent, etc.

-

Token Buyback Mechanism:

The payments made in $NATIVE tokens are used to buy $AGENT tokens from the Revenue Pool. Of the total amount purchased:- 10% is burnt,

- 90% is returned to the original Agent Owner.

-

Value Appreciation:

This mechanism helps increase the value of the $AGENT tokens held by early investors and the Agent Owner. The tokens can then be exchanged via the Revenue Pool or on the open market.